s corp tax calculator nyc

We are not the biggest. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the.

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

Not more than 100000.

. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. 1 Select an answer for each question below and we will calculate your S-corp tax savings. Discussion And Analysis Of Significant Issues Related To Accounting For Expenses.

For example if you have a. More than 500000 but. Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence.

Forming an S-corporation can help save taxes. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. Smaller businesses with less net income will only have to pay 65.

This calculator helps you estimate your potential savings. Forming an S-corporation can help save taxes. If your business is incorporated in New York State or does.

Ad Payroll So Easy You Can Set It Up Run It Yourself. This application calculates the. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

More than 250000 but not over 500000. Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3.

If New York City Receipts are. This calculator helps you estimate your potential savings. Taxes Paid Filed - 100 Guarantee.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Taxes Paid Filed - 100 Guarantee.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. This could potentially increase the S-corp tax bill significantly and.

10 -New York Corporate Income Tax Brackets. Ad Potential Impacts To Income Tax Accounting Including Interim Estimates And Allowances. More than 100000 but not over 250000.

Fixed Dollar Minimum Tax is. Ad Payroll So Easy You Can Set It Up Run It Yourself. As a sole proprietor you would pay self.

From the authors of Limited Liability Companies for Dummies. A What is your. Another way that corporations can be taxed is directly on their business capital less certain liabilities.

Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022.

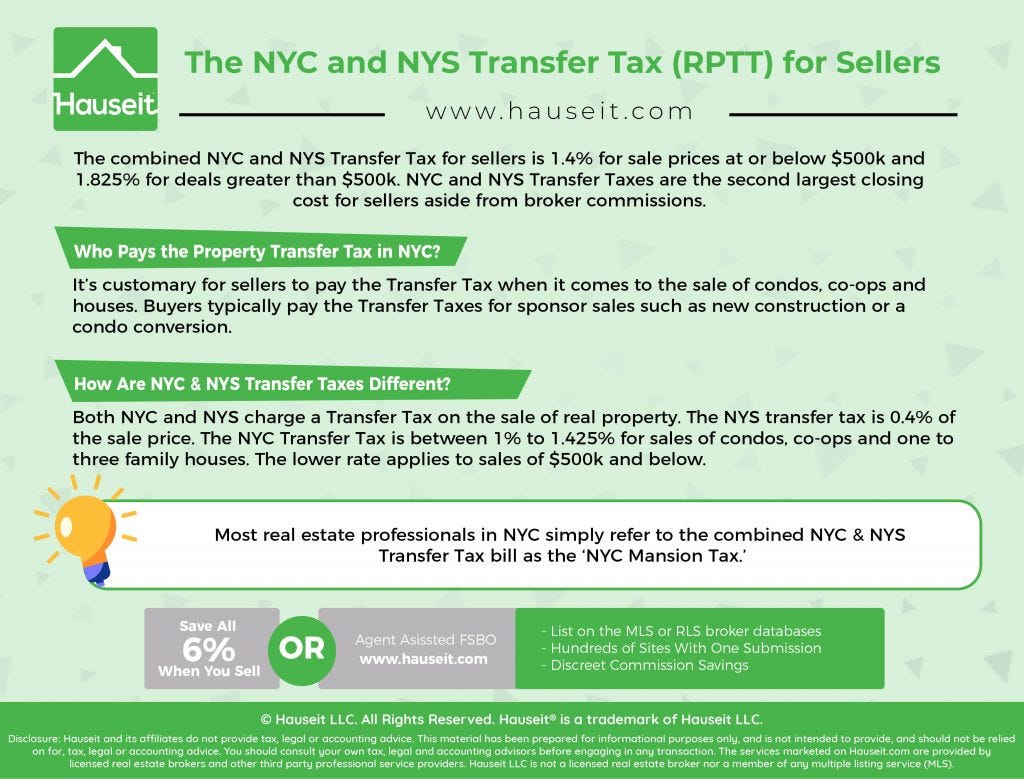

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

The Best Working Tax Credit Number This Was The Best Support Number We Could Find For The Working Tax Credit Customer Service Work Tax Credits Tax Credits

The Nyc And Nys Transfer Tax Rptt For Sellers By Hauseit Medium

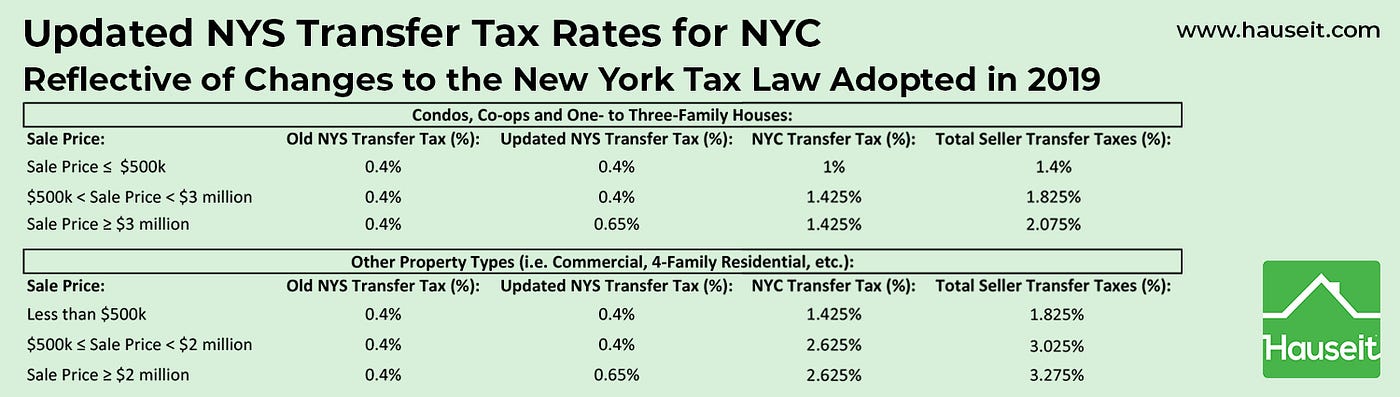

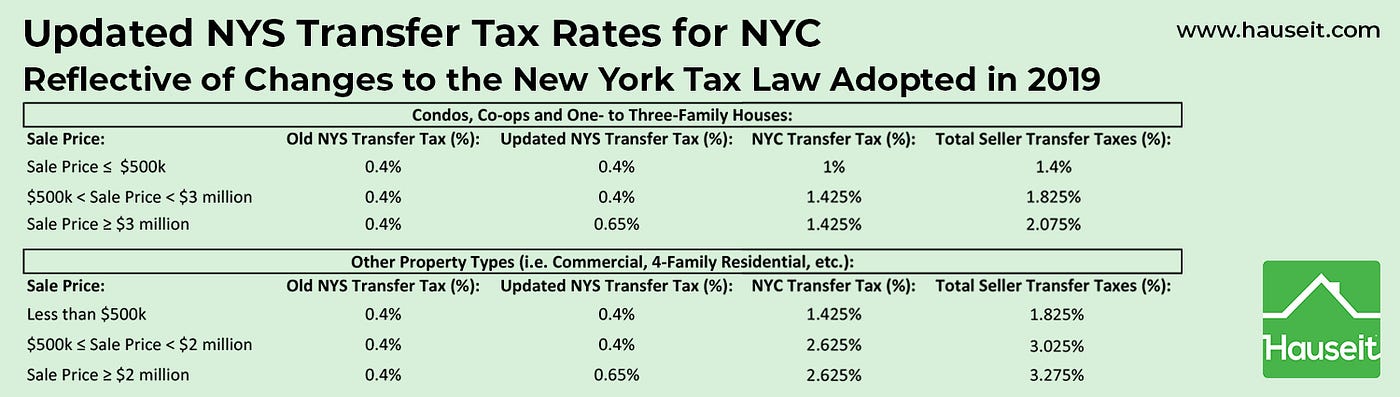

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

Ny State And City Payment Frequently Asked Questions

My Nyc Employer Will Pay Me 10k Relocation Money How Much Of It Will Be Withheld For Tax Purposes Quora

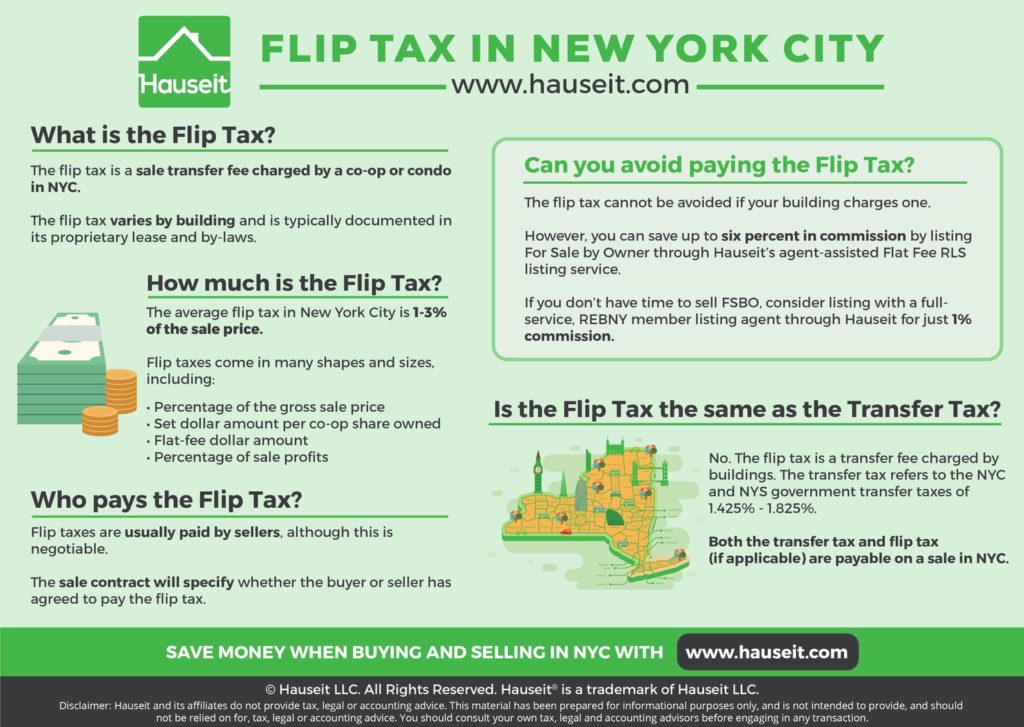

Flip Tax In Nyc What Is The Average Flip Tax And Who Pays It Hauseit

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How Much Will I Have To Pay In Taxes As An Intern In New York City Quora

The Most And Least Tax Friendly Major Cities In America

New York City Taxes A Quick Primer For Businesses

New York State Enacts Tax Increases In Budget Grant Thornton

New York City Taxes A Quick Primer For Businesses